Business closures happen for different reasons — but no matter what caused the business to close, it’s important to understand that you can’t simply stop operating.

As a business owner or self-employed individual running a freelance business, it’s your duty to perform the due diligence required to properly close the business. Your business registration needs to be officially recognized as void, otherwise, you risk facing serious legal and tax consequences.

This article is a guide on how to close a business in the Philippines. You’ll learn about the most important elements that make up a proper closure of business. It Includes the steps, time frame, and procedures to ensure a trouble-free closure of business.

Note: If you hired an accountant to file your taxes, it is best to consult with them first for guidance.

What is Closure of Business?

A business closure is the result of a company or organization shutting down or ceasing to operate. It’s also sometimes referred to as “retiring a business”.

It essentially terminates the legal existence of the business by informing a few key government agencies and local units by submitting all required documentation (and paying all applicable fees) By doing so, you can free the business from any further tax obligations.

8 Reasons why your business might need to be closed

- Bankruptcy

- Debt

- Not turning in a profit / business losses

- Poor location

- Bad business strategy

- Low-quality product/service

- Lower demand for the industry

- Unforeseen events (pandemic, natural disasters, etc.,)

Why is it important to properly close a business?

As the registered owner, if you fail to close your business properly, you could face a number of legal issues and tax liabilities.

As mentioned earlier, you can’t simply stop operating. If your business is still registered, your business is still operational in the eyes of the law.

When closing down your company, consulting services can prove helpful, but entrepreneurs need to be aware of things they should and should not do.

This includes properly informing both employees and suppliers/partners about their intentions so that any outstanding dues can be settled and other obligations fulfilled before the company is deemed as officially closed.

Here are the possible penalties for failing to close a business:

-

Criminal and civil penalties (tax audit issues)

-

Compromise penalties stemming from open cases

-

Fees and other penalties from the LGU

How long does it take to close a business?

In the Philippines, the complete process can take anywhere from a few months to a year, possibly even more, depending on the situation.

If you have any outstanding issues (missed BIR filings, for example), expect it to take more time simply because the government needs to review and settle them all before your business can be officially recognized as non-operational.

If you’re closing down your business in the Philippines, you’ll need to provide notice of closure and termination to employees. You should notify DOLE at least 30 days prior to the planned date of closure. In addition, you’ll need to provide separation pay to your employees.

What type of business do you have?

Before you proceed with the steps, it’s important to note that the actual process may vary depending on the type of business classification you have.

For sole proprietorship:

For freelancers, self-employed individuals, freelance business owners, and similar groups, the Department of Trade and Industry (DTI) needs to be notified of your decision to cancel.

For partnerships and corporations:

For businesses, organizations, and cooperatives, the Securities and Exchange Commission (SEC) must be notified of your cancellation of business.

Also read: 5 Important Questions to Ask Yourself Before Starting Freelancing

Steps to properly close a business in the Philippines

There are several steps required to start the process of business closure in the Philippines. Here’s a bird’s eye view of the steps for each corresponding regulatory agency/government unit. Note that you may or may not need to visit each entity, that depends on the type of business you have (as explained in the previous section).

Business closure at the Barangay and LGU level

Before you visit the barangay, make sure to bring all the requirements mentioned below along with some money to pay for any fees.

List of Requirements for business closure at the barangay:

-

Letter Request for Retirement of Business

-

Original copy of Latest Business Permit

-

Valid ID

-

For Single Proprietorship:

-

Original copy of Affidavit of Closure bearing exact date the business was closed

-

-

For Partnership:

-

Original Partnership Dissolution document bearing exact date of business closure signed by all partners

-

-

For Corporation:

-

Original Secretary’s Certificate or Board Resolution on closure or transfer of the business bearing the exact date of closure.

-

Steps for business closure at the Barangay:

Go to the Barangay hall to request a Barangay Certificate bearing the exact effective date of closure. You must submit a Letter of Request for Retirement in order to obtain the retirement certificate. In addition, you will be provided with a Barangay Clearance / Certificate of Closure.

Sample letter of Request for Termination of Business

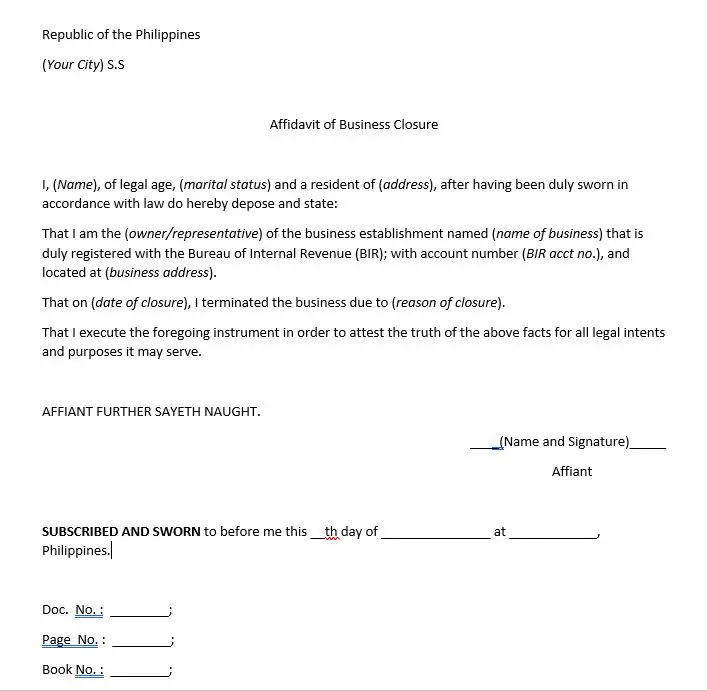

One of the first documents that you’ll be asked to provide in requesting for a cessation of your business is an Affidavit of Business Closure. To give you an idea of what it looks like and what it contains, here’s a sample:

Steps for Business Closure at the City Hall

Business owners who want to avoid getting assessed further taxes while their business is closed must file for Closure of Business and Cancellation of TIN with the Bureau of Internal Revenue (BIR). All business notices and corresponding permits need to be surrendered. You might also be required to submit an affidavit of loss if the business name certificate or a copy of the original application form was lost.

Note: Steps may vary depending on your business location. The following are the steps to close a business in Quezon City (QC LGU).

For businesses established in Quezon City, the City Treasury Department – Examination Division must be contacted to declare a business closed.

Steps for Closure at the City Hall

-

Notice of intent to close business addressed to the City Treasurer and copies forwarded to the Department of Business Permits and Licensing

-

Original copies of Tax Bills and Receipts

-

Original copy of Latest Business Permit

-

If Single Proprietorship, original Affidavit of Closure with exact date of closure.

-

If Partnership, original partnership dissolution with exact effectivity date of closure signed by all partners.

-

If Corporation, original Secretary’s Certificate or Board Resolution on closure or transfer of business with exact date of closure.

-

-

Valid ID

-

Barangay Certificate (the clearance which you obtained from the first section)

-

BIR Certificate of Registration

-

Book of Accounts, business plate, income tax returns

-

VAT Returns or Percentage Tax Returns

Also read: Complete List of Philippine Mobile Networks

Steps for BIR Business Closure

According to the BIR, “taxpayers who filed for cancellation of registration due to closure/cessation of business or termination of business shall be subjected to immediate investigation by the BIR office concerned to determine the taxpayer’s liabilities”.

1. Visit the nearest BIR office to apply for Closure of Business and Cancellation of TIN along with the following list of requirements and/or documents:

-

Closure Notice / Cessation of Business / Notice of Closure

-

All business permits and notices and COR

-

Unused sales invoices and official receipts (delivery receipts, purchase orders, credit memos, etc.,)

-

Tax returns or other related business documents (books of accounts, etc.,)

General Steps:

-

Taxpayers must file Form 1905, together with the attachments, with the Revenue District Office (RDO) within ten (10) days after the business ceases operations.

-

Income tax return for a short period is filed by the taxpayer.

-

Using the Integrated Tax System (ITS), the RDO determines whether taxpayers have open cases. If there’s any, the taxpayer will be required to submit the returns and to pay any corresponding tax due as well as any penalties.

-

Taxpayers’ delinquent cases are verified through the Assessment, Collection, and Legal Divisions of the Region. Same will be done in the Collection Enforcement Division, BIR National Office.

-

Before ceasing to do business, RDO requests a Letter of Authority to investigate all unaudited taxable years.

-

A Case Officer assigned to the case will conduct investigations for the period/s covered in the Letter of Authority.

-

Form 0605 is used to pay corresponding deficiency taxes resulting from an audit by the taxpayer.

-

Business closure is approved by the RDO.

-

RDO updates ITS and cancels TIN of taxpayer for non-individual taxpayer.

Steps for Application for Closure at DTI and SEC

If your business type is a partnership or a corporation, the last step is to submit your intent to stop your business operation.

Business closure requirements of DTI for Sole Proprietors:

-

A completed and signed Other BN-Related Application Form specified in Annex D must be submitted;

-

The owner of the BN must present one (1) valid ID according to Annex A;

-

Submit your declaration under oath that the cancellation isn’t intended to defraud creditors, that the business does not have any outstanding financial obligation with creditors, or that you have notified all creditors of the cancellation;

-

Presentation of the authorized representative’s valid ID when filing the application if the application is filed by a representative;

-

Fees payable in accordance with Annex E.

-

Affidavit of Cancellation

Business Closure Requirements of DTI for Partnerships and Corporations

-

The authorized signatory must sign the letter request (see Board Resolution for authorized signatory)

-

A certified photocopy of the dissolution certificate from the SEC

-

The original of the certificate of registration for the business name and a duplicate of the application form. The affidavit of loss (if the duplicate of the application form or the certificate of business name was lost)

Also read: How to Start Working from Home